Are You Maximizing Your HSA Usage?

Your health savings account (HSA) can do more for you than you might think. HSAs are a type of savings account that people with high-deductible health plans (HDHPs) can contribute to and use to cover their medical expenses. But it can also be a useful tool for building and protecting your wealth. Want to learn…

Protect Your Wealth for the Future

Economic uncertainty is a part of life. Markets can be unpredictable day-to-day, let alone years into the future. That uncertainty is one of the many reasons people want to start estate planning, so they can protect their loved ones and leave a legacy. Protect Your Assets Protecting your assets is the ultimate goal of estate…

Make Your Donations Strategic

As you build your wealth, you might be thinking about ways to give back. Charity is a valuable way to support causes important to you. Learn how charity can become a part of your financial strategy. How Charitable Giving Can Work for You Charity is a generous act, and financial planning can help maximize the…

Tax Cuts and Jobs Act

Tax Act Overview The Tax Cuts and Jobs Act of 2017, which we will simply call the “Tax Act”, is not retroactive except for a very few unique expensing provisions, so for nearly everyone, your upcoming income tax filing due this spring for the 2017 tax year filing will NOT be effected. However, the changes…

Retirement Savings Mistakes to Avoid

A long-term savings strategy like planning for retirement relies on small steps taken over an extended period of time. Make sure you’re on track by avoiding these common mistakes. Underfunding Retirement Accounts Are you among the 71 percent of Americans who aren’t putting enough away for retirement? The most effective determining factors of a well-funded…

3 Ways to Prepare Now for Taxes

It may seem early, but the start of a new year is an ideal time to get your ducks in a row when it comes to tax preparation. Use the following tips to get some work done now and avoid the panic of procrastination. Revisit Your Usual Routine The bulk of tax prep comes down…

Alternative Minimum Tax (AMT)

Well, it’s almost April 18th (the tax deadline is extended three days this year). If you’re like most people waiting until the last minute to file, you likely anticipate owing taxes instead of receiving a refund. And, if you owe tax, you may have higher than average income, which means at some point, you could…

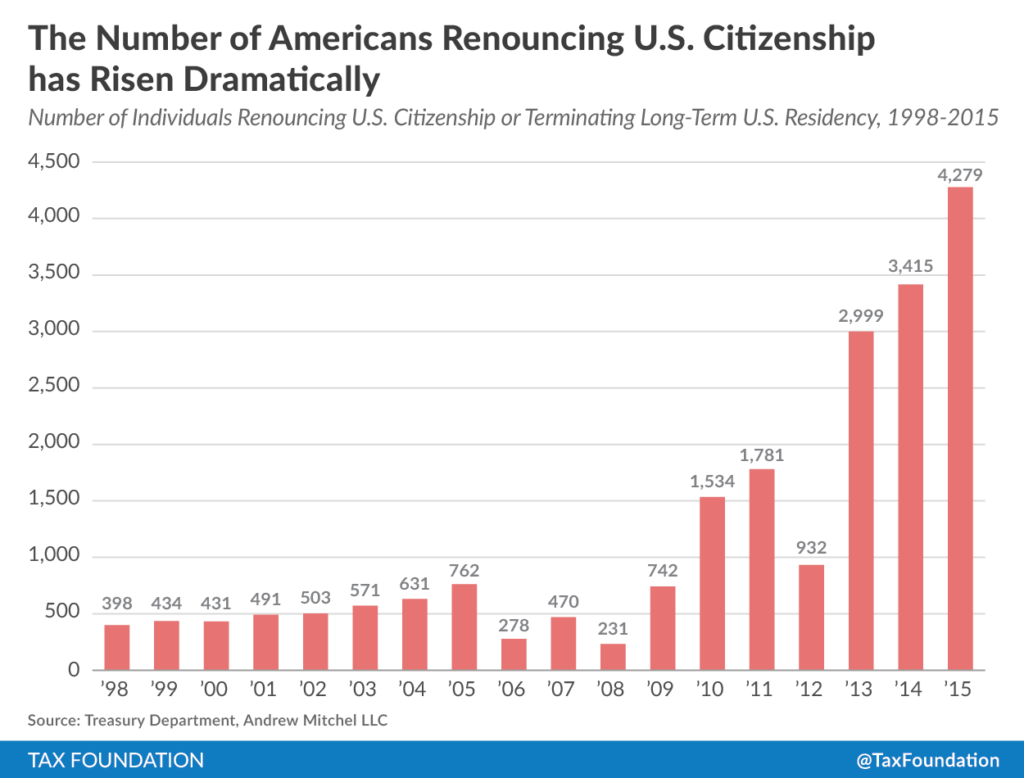

Record Numbers Renouncing U.S. Citizenship

According to the Treasury Department, 4,279 people renounced their American citizenship in 2015. This is up 864 from the previous high of 3,415 in 2014. From 2013 to 2015, 10,693 citizens have renounced their citizenship, which is more than the 10,189 renouncements in the previous 15 years from 1998 to 2012. So why are so…

The IRS Phone Scam

As we all know, there are many scams taking place every day in our modern world, but one of the fastest growing is an IRS scam. So, with tax season fast approaching, we wanted to make you aware of the latest tactic by scammers to use you and the IRS. In short the scam involves…

recent comments